Once the bastion of stability, the financial services industry is now facing new challenges from every vantage point. Disruptive competitors, regulatory reform, fickle customer loyalties, changing employee expectations and reputational damage are stalling growth and increasing churn for traditional operators. While your organization needs to defend its ground, conventional weapons are no longer sufficient to maintain revenue or profits. The key to winning the battle is to change how your customer-facing people serve your customers.

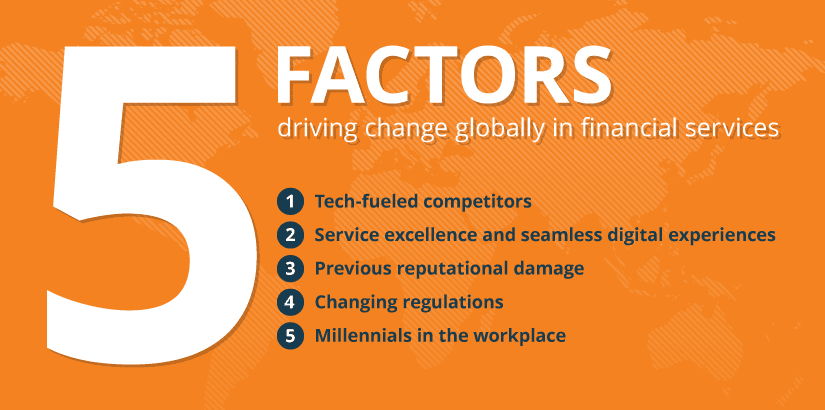

There are five factors driving change globally in financial services

- Tech-fueled competitors are disrupting sales strategies:With a focus on personalization and self-service, modern platforms deliver superior customer experience quickly. They also use data to understand customer pain points and finetune how their sales teams deliver an effortless experience.

- Service excellence and seamless experiences set new benchmarks:In a digital world, customers expect their services to be delivered conveniently and effortlessly. Subscription models have also reshaped brand loyalty with customers needing to experience value or opting out.

- Reputational damage has affected consumer confidence:Over the past decade, events like theWells-Fargo scandal

and the subprime mortgage crisis have left customers disappointed and frustrated. Lingering consumer sentiment continues to impact the industry’s reputation.

- The financial services industry is under a regulatory microscope:Laws surrounding risk management and compliance are constantly changing. This places additional pressure on your frontline to ensure they’ve met compliance obligations when dealing with customers.

- The workforce requires more flexibility:As baby boomers move into retirement, millennials and Generation X comprise the majority of the workforce. Organizations must take into account new preferences, like short bursts of information and digital solutions, when designing how people work.

While your organization can’t directly control market or regulatory responses, you can control how you deal with these challenges. By focusing on the skills and aligned behavior of your employees and the experience that they deliver to customers, your organization can have some control over how your customers respond.

Your people are key to delivering a superior customer experience

With the financial ecosystem evolving so rapidly, customer experience is increasing in importance. It is no longer just about providing good service – it’s about fostering lifelong partnerships that require understanding, problem solving and engagement. This means customer-facing staff need to be ready to stand and deliver every time. By focusing on customer readiness drivers your people can execute a best practice experience.

There are five customer readiness drivers you can double down on to empower your customer-facing people:

- Align culturewith customer-focused value: At each level of your sales organization, the desired culture needs to be defined and implemented. For culture to be an effective customer-readiness driver, you also need to systematically test the behaviors you desire to ensure they are executed consistently.

- Adopt a solutioningapproach to customer engagement: Thanks to the internet, by the time a customer comes into contact with your salespeople they often know what solution they think

they need. This can create friction in the customer experience that can be addressed by implementing a systematic way of providing salespeople with access to the right information and the capability to apply it.

- Facilitate compelling compliancebehaviors: Every back office process and customer interaction is guided by a constantly evolving framework of regulations, processes, and behaviors that must be met. Rather than being a roadblock, these can be an opportunity to reaffirm to customers that they’re in safe hands if compliance is seamlessly incorporated into your salespeople’s behaviors and skills.

- Implement agile transformationmethodologies: Most organizations have embarked on a process of transformation to improve and change how their business operates. To embrace accelerated change, your salespeople need to have the agility to keep up and engender confidence in their customers.

- Distribute campaignplaybooks to the field: Financial organizations often run multiple campaigns or new solution launches at any one time. Campaigns are only an effective customer readiness driver if they add value to customers, which requires salespeople to understand how it benefits their customers.

Arm your salespeople to deliver a superior customer experience

To deliver a superior customer experience and win and retain customers for longer, your sales organization needs to deliver on these customer readiness drivers. To achieve this, many look to traditional methods of training their salespeople, but these have not been designed to address the challenges facing organizations today. To build salesforce capability and meet customer needs your sales organization needs to be able to:

- Build confidence with knowledge:In a digital world, your salespeople need to build more knowledge in a short amount of time. They also need to find new ways to stay one step ahead of their customers while creating a personalized experience. Coupled with generational changes in learning preferences, this requires knowledge to be packaged and delivered in new ways.

- Test the ability to execute:While it’s important that salespeople have the right information at their fingertips, that knowledge is of no value if they can’t apply it to specific scenarios. New learning tools, from gamified testing to video practice, allow your salespeople to practice and hone their skills.

- Coach for improvement:To be a significant driver of performance, coaching must be targeted and consistent. Smart technology solutions can help organizations create a consistent coaching cadence.

- Certify and measure success:Data has the potential to take sales organizations from being reactive to implementing proactive and targeted skill development. Modern tools enable businesses to capture, correlate and apply data across their sales organization in a powerful way.

To address the challenges you are facing in the digital age, your sales organization doesn’t have a minute to lose. You need to arm your people with knowledge, capabilities, and processes that allow them to put their customers at the center of everything they do. To create a best practice customer experience, your salespeople need tools, platforms and services that can help them achieve this. Get in touch with Mindtickle to find out how you can arm your salespeople to deliver a superior customer experience.

To learn more, download our full eBook: Driving Customer Experience from the Frontline of Financial Services

By Vivian Batman

By Vivian Batman

By Rahul Mathew

By Rahul Mathew

By Aman Bafna

By Aman Bafna