Mindtickle empowers revenue leaders to transform the capabilities of their teams through learning, upskilling, and coaching

SAN FRANCISCO—November 15, 2020—Mindtickle, the leader in Sales Readiness technology, today announced that it has raised $100 million in a combination of equity and debt financing, led by Softbank Vision Fund 2¹ to prepare customer-facing employees everywhere to drive revenue growth. Existing investors, Norwest Venture Partners, Canaan, NewView Capital, and Qualcomm Ventures also participated in the round. This will be used to accelerate Mindtickle’s go-to-market activities and expansion of global operations while advancing investments in product innovation to close the loop on customer-facing readiness and in-field execution.

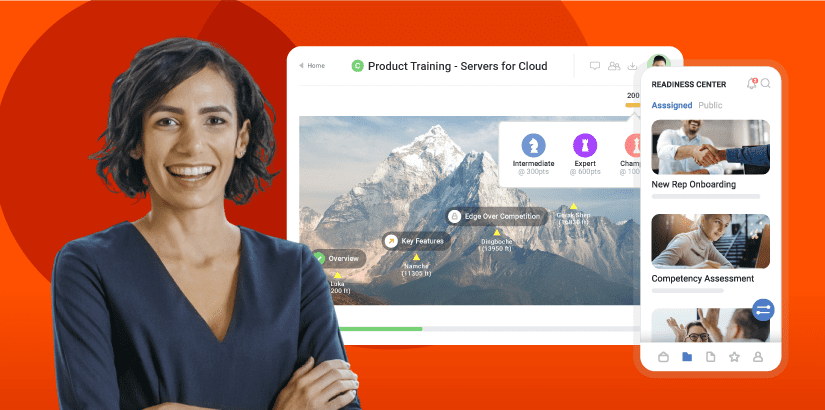

Mindtickle’s SaaS platform enables enterprises to ready their customer-facing teams for the “moment of truth” — when they interact with their customers. Organizations use Mindtickle to drive programs, such as onboarding, ongoing learning, role-playing, upskilling, and coaching to ensure that all customer-facing employees have the right capabilities and behaviors needed to drive revenue growth. With Mindtickle, more than 200 enterprises, including more than 40 of the Fortune 500 and Forbes Global 2000, have achieved significant, measurable improvement in revenue metrics, such as ramp time, quota attainment, and win rate. Mindtickle’s comprehensive, data-driven Readiness platform unlocks such unparalleled results by measuring teams’ capabilities and behaviors and correlating them with outcome metrics to identify gaps. It leverages AI and machine learning engines to serve personalized remediations and reinforcements to bridge these gaps. And Mindtickle’s modern, mobile-first user experience and engaging gamification techniques make it delightful for the end-users, resulting in increased adoption and greater revenue impact.

“Our mission is to help companies transform the capabilities and behaviors of their teams to generate a meaningful, measurable impact on their revenue and brand,” said Krishna Depura, co-founder and CEO of Mindtickle. “As customers become increasingly demanding and remote work becomes more common, organizations realize the need to reskill and upskill their employees on an ongoing basis to deliver value in each customer interaction. As a result, we have witnessed strong demand and usage growth from enterprise sales teams over the last few quarters. Interestingly, we are also seeing a strong flow of interest from other enterprise teams, who are intrigued by the success of their sales-peers with Mindtickle, and are choosing to adopt this new technology for their respective functions.”

“Helping our customers accelerate their hybrid and multi-cloud strategies meant accelerating our own sales transformation and how we enable our customer-facing teams to engage with our prospects and customers. Mindtickle has been a key piece of that transformation,” said Roslyn Jones, vice president, NetApp Learning Services. “A systematic approach to ensuring our sales and other customer-facing teams have the right knowledge at the right time and mix of hard and soft skills to be successful means they can take a more consultative approach, ultimately making our customers more successful in their cloud initiatives.”

This funding follows recent industry awards and accolades for Mindtickle. The 2020 Aragon Research Globe™ for Sales Coaching and Learning positioned Mindtickle as a Leader and Gartner’s 2020 Market Guide for Sales Enablement Platforms named Mindtickle as a representative vendor meeting all eight top use cases. In addition, Mindtickle was voted the #1 Enterprise Software Product and the 5th ranked sales software product on G2’s Best Software 2020 lists.

“We have been impressed by Mindtickle’s vision of closing the capability loop and bringing deep insights and actionable intelligence to revenue and business leaders,” said Munish Varma, Managing Partner at SoftBank Investment Advisers. “We believe that Sales Readiness is experiencing a paradigm shift, as enterprises face the new reality of hybrid-remote work.”

“Mindtickle’s track record of growth, quality of product and marquee customer base highlights their strengths,” added Sumer Juneja, Partner at SoftBank Investment Advisers. “By delivering engaging and personalized training to users, Mindtickle is uniquely placed to support businesses to increase revenue generation and extend critical capabilities within their existing workforce.”

For more information about Mindtickle’s latest funding, please visit our website here.

About Mindtickle

Mindtickle provides a comprehensive, data-driven solution for sales readiness and enablement that fuels revenue growth and brand value for dozens of Fortune 500 and Global 2000 companies, and hundreds of the world’s most recognized companies across technology, life sciences, financial services, manufacturing and service sectors. With purpose-built applications, proven methodologies, and best practices designed to drive effective sales onboarding and ongoing readiness, Mindtickle enables company leaders and sellers to continually assess, diagnose and develop the knowledge, skills, and behaviors required to effectively engage customers and drive growth. Please visit our culture page and our current job openings to learn more about us and career opportunities. For additional information, visit www.Mindtickle.com or find us on LinkedIn, Facebook and Twitter.

Media Contact:

Public Relations at Mindtickle

pr[at]mindtickle.com

¹ As of the date of this press release, SoftBank Group Corp. has made capital contributions to allow investments by SoftBank Vision Fund 2 (“SVF 2”) in certain portfolio companies. The information included herein is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy limited partnership interests in any fund, including SVF 2. SVF 2 has yet to have an external close, and any potential third-party investors shall receive additional information related to any SVF 2 investments prior to closing.

# # #